This post is applicable to any kind of business. In a follow-up post, I will use this technique to walk through the design of a set of metrics for a SaaS company. Since SaaS businesses (or any other subscription-based business) are different from standard software businesses, we will uncover some interesting elements.

Think of Your Company as a Machine

One way to look at how companies work is to imagine them as a machine that has Outputs, along with Levers (Inputs) that you, the management team, can pull to affect its behavior.

Weak management teams have only a limited understanding of how their machines work, and what levers are available to affect performance. The better the management team, the better they will understand how that machine works and how they can optimize its performance (what levers they can pull).

When we look to design metrics, we want to deepen our understanding of the machinery, and how it works. Well-designed metrics will automatically drive behavior to optimize output from the machine.

Example of a Bad Board Meeting to Review Business Success Metrics

Here is an example of a bad board meeting, which happens far more frequently than you might imagine. The company just missed its quarterly revenue forecast. Good board members want to know two things:

- Why did this happen?

- What can be done to avoid the problem going forward?

As they ask management what happened, they responded that the market was tough, and deals just didn’t close the way that they hoped. They also do not have a great plan for what they are going to do differently next quarter, other than hope that the market improves and that more deals will close.

Hope is not a strategy.

Example of a Good Board Meeting to Review Business Success Metrics

The better management teams answer those questions differently. They will gradually peel back the covers of the machine, like peeling the layers of an onion, and expose the true nature of the problem, which of course will also highlight what levers they need to pull to fix the problem. Let’s take an example:

- They tell you that revenue is composed of deals. To compute revenue, you multiply average deal size by number of deals. They may tell you that they aimed to grow their average deal size to $x, and were successful in hitting this target. But the number of deals that they closed was below target.

- They then peel back the onion one more layer, and tell you that the number of deals was below target because a third of the salesforce missed their targets.

- They will then peel back another layer, and tell you that the reason those salespeople missed their targets was because they were not handed the required number of trials from marketing. However, for the trials that they did receive, they successfully converted them to closed deals at the expected conversion rate.

- Peeling back another layer, they tell you that the number of trials is equal to the visitors to the site x, the conversion rate of those visitors to trials. They tell you that the number of visitors was on target, but the conversion rate fell below the previous levels.

- Peeling back one more level, they tell you that they ran three major campaigns to drive visitors to the site, as well as relying on the normal levels of word of mouth traffic. They then reveal the true source of the problem: the ads that they had started running on Facebook were delivering a far lower conversion rate to trials than in prior months.

The contrast between the two approaches is stark. In the second case, management clearly knows how to fix the problem (by adding new traffic generation programs). They also know precisely how much additional traffic needs to be generated to reach the growth targets, and how many sales people they need at a given productivity level, etc.

What is surprising is just how few management teams truly have their act in order in this area. For Web and SaaS businesses with smaller transactions at higher volumes, this kind of modeling and tracking is much easier, as web-based lead generation and marketing have easy-to-implement measurements. After all, the greater the volume of transactions, the more clearly patterns emerge. This is harder to do for channel sales (and even more so for direct sales with large deals), but still extremely valuable.

The Secret to Success in Sales Conversion Business Metrics

The secret to successful design of metrics is to start with the end goal and work backwards. In most companies, the end goals that matter the most are the following:

- Profit/Loss

- Growth

- Good cash flow

(You may wonder why we don’t have Revenue in this list. Read further.)

Let’s take the first of these (Profitability) and work backwards. Working backwards means looking at the components that make up Profitability:

Profits (EBITDA) = Revenue – Cost of Goods Sold – Expenses

To focus the management team on driving profitability, we should also track and measure Revenue, CoGS, and Expenses. Obvious, isn’t it? Well, this same principle can be applied over and over again, focusing on the components of Revenue, CoGS, and Expenses where needed.

The next step is to take Revenue, CoGS, and Expenses, and break them down to the key components. Bookings is the precursor to Revenue. Let’s look at Bookings as an example:

Bookings =No of deals closed * Average Deal Size

For Reseller Channels, we might be looking at something different such as this:

Revenue = No of productive resellers * average productivity per reseller

Note: Many businesses have several categories of deals (e.g. large deals and smaller deals, or deals from two or more different categories of customers). Because of this, the formula may have more elements to it than shown above.

Peeling back another level, we might find the following:

No of deals closed = No of productive sales people * Average Productivity per Sales person

There will also likely be another formula to compute this, which will look like the following:

No of deals closed = No of Trials * Average Conversion Rate

These two formulae clearly indicate some of the levers that we have available to increase Bookings. We can grow the number of trials, or grow the number productive sales people– or we could try to increase the average productivity of our salespeople. However, we need to ensure that we grow them both together. Otherwise, we could end up out of balance (for example, too many sales people and not enough trials to feed them, or too many trials and not enough productive sales people to close them).

The next step would be to peel back the onion a few more layers:

No of trials = No of visitors to the web site * Average Conversion Rate to Trials

No of Visitors to the web site = Normal traffic + for each traffic generation campaign: target audience of each campaign * Conversion Rate to visitors

Each time, we peel back a layer to expose the components. This way, we gain a better understanding of our machine and the levers that we can pull to make it work better. In the above two formulae, we can see that a big driver of the model is visitors to the web site. But this can be expensive to increase. So the other variable that we can try to increase is the conversion rate for each campaign, and the conversion rate to trials. To do this, we can alter campaign messaging and landing pages, using A/B testing to find the optimum creative content.

We might also decide to focus our efforts on increasing the average deal size. We could do this in several ways:

- Cross-sell to add additional products

- Upsell to add seats, or premium features

- Develop a scalable pricing matrix that does a better job of charging higher-end customers that are willing to pay more. This might involve several new axes that increase pricing, such as charging per seat, or charging per 1,000 data elements tracked, or charging for 24/7 support, etc.

As with many good ideas in business, all of the ideas above are obvious, and follow common sense. However, surprisingly few businesses have fully peeled back the onion to expose all the major variables and levers, and then implemented appropriate metrics to track these over time.

Sales Metrics Trend Analysis

For every major variable that matters in our model, we want to track how this varies over time. This will show us if we are succeeding in our efforts to improve things, and also give us early warning signs of any negative trends.

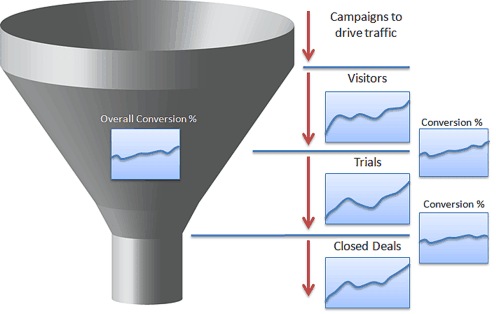

For most stages in a sales and marketing pipeline, we want to track two metrics: how many prospects we put through that stage, and how effective we were at converting them to the next stage. For example:

| Stage in Sales Funnel | No of Prospects | Conversion Rate |

| Campaigns to drive traffic | People seeing the campaign | Conversion % to Visitors |

| Visitors | Site Visitors | Conversion % to Trials |

| Trials | No of Trials | Conversion % to Closed Deals |

| Overall Sales Process (start to finish) |

No of Visitors | Conversion % to Closed Deals |

Peeling Back the Onion on Inside Sales Performance

Metrics can be extremely useful for managing an inside sales (telesales) organization. Starting with the overall sales number achieved by the whole group, let’s peel this back layer by layer to see what we can learn:

- Overall group performance = Sum (individual contributor performance)

We need to look at how each individual has done relative to the average levels to understand the strong and weak performers.

- Individual performance = No of deals closed * Average Deal Size

For the weak performers, the number of deals closed will likely be lower than we want. The question is why?

What are the components that make up the number of deals that an individual closes? Assume a sales process where each inside salesperson is handed a queue of marketing qualified leads, calls them to try to schedule a demo, and then tries to close a sale. The components will be the following:

- Calls made per sales person (If this is low, they will quickly react to peer pressure when they see other sales people’s call rates.)

- Conversion rate to returned calls (If this is low, the sales person is not leaving compelling voicemails, and should be given training by someone who has a high conversion rate.)

- Conversion rate from phone calls to demos (If this is low, the salesperson’s ability to convey the value proposition is weak, and they should be given training by someone with high conversion rates.)

- Conversion rate from Demos to Closed Deals (If this is low, the sales person needs better demo training.)

- Average Deal Size (If this is low, the sales person may need better training on cross-selling, or upselling.)

The above may not mirror your inside sales process, but hopefully the method of working backwards from the end goal, and peeling back the layers to expose the components, enables you to map out the metrics that matter to you.

Sales and Marketing Funnel – Summary Metrics

We should also look at some metrics that cover the entire sales and marketing funnel from top to bottom. Here are some example metrics that are important at this overall level:

- CAC – total cost to acquire a customer (see previous blog post Startup Killer: the Cost of Customer Acquisition to understand why this is so important)

Lead source effectiveness:

- CAC by lead source

- ROI by lead source (takes into consideration cost, conversion rates to closed deals, and lifetime value of customers that came through that particular lead source)

What Not to Track for Successful Sales Metrics

Some categories such as Expenses are made up of many line items. We likely don’t want to bother with metrics for every line item, so we need to answer the following question: How deep should we go with our analysis? The answer to this is pretty much common sense:

- Prioritize the components that have the biggest effect

- Don’t put much effort into tracking things that you can’t affect

- Don’t bother tracking items that are small, or that don’t vary much. Leave these to accounting.

Sales, Conversions, Startup Business Success Metrics Conclusions

Nothing in this article should be surprising or earth shattering. However, as is often the case in business, it is really easy to have the vision of what to do, but far harder to execute on that vision. In my experience, the mark of a well-run business is that they actually have the systems in place to automatically produce these metrics. They use those metrics as part of the management process to run the business.

The Benefits: Good Metrics Drive Actions and Behavior

One of the greatest things about using the right metrics is that showing them to people will encourage them to improve the metrics. Furthermore, the metrics clarify what levers they can use to change performance.

Well-Designed Metrics Show What Actions Are Needed

Working backwards from a specific Revenue target, management can understand all the other elements that have to be put in place to reach that target. For example, if you want to hit $xm in bookings for the quarter, you can work out:

- How many salespeople you need

- How many leads the salespeople need

- What marketing campaign spend you need to generate those leads

If you are in a channel model, you can work out how many productive resellers you need. Given a known conversion rate from newly signed resellers going through an onboarding process, you can work out how many new resellers you need, and how many onboarding sales training sessions need to be run.

===============================

Re-posted in full with the author’s approval. The original version can be seen here:

http://www.forentrepreneurs.com/designing-startup-metrics-to-drive-successful-behavior/

For many other excellent posts on business, business success, sales, marketing, and other resources please see David Skok’s excellent site at